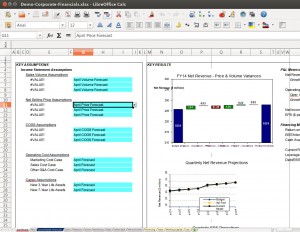

IBM and Apple recently announced a collaborative effort to develop new suites of apps for various industries. Ironically, this news broke during the same week that a CEO told me of his interest in a financial model app because he wanted “to do more with his iPad than just check e-mail and surf the Web.”

Many C-suite executives are comfortable with quantitative work and understand the value of financial models in guiding critical decisions. However, their desire to take a deep dive into the numbers is often thwarted by the often unintentional (but sometimes deliberate) complexity of existing tools. Whether Finance groups like it or not, the development of new apps will bring more calls for user-friendly financial models that could wind up on the screens of many senior executives.